ANTI -MONEY LAUNDERING

The risks for lawyers of being involved in money laundering or failing to comply with anti money laundering (AML) compliance obligations are significant, both financially and reputational.

GB Group

We use GB Group’s ID verification service – ID3Global for anti money laundering and identity check services because they use the widest range of international identity data that is currently available in the market.

Anti Money Laundering Checks

The AML checks conform to UK and international AML and KYC standards and legislation. The following databases are used:

Understanding AML Results

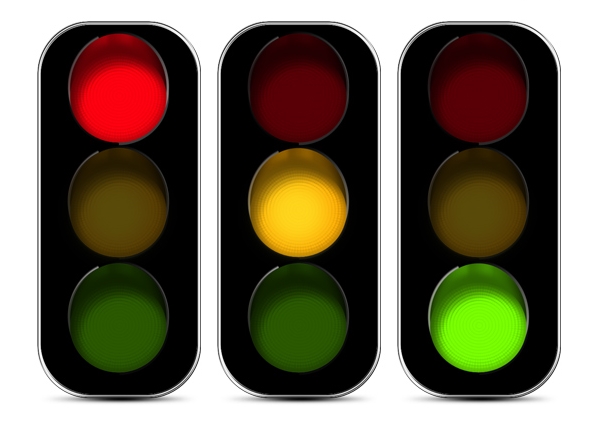

Simple and Clear Decision with Points Score.

- Results are based on points scored where personal data is matched in various databases.

- Where enough data is matched the result will be a Pass.

- Where some data is matched then the result will be a Refer.

- If a negative data source is matched or a document is invalid then the result will be Fail.